night man1965/iStock via Getty Images

In recent months, dry bulk transportation has suffered heavy losses due to various factors. From monetary tightening to the Russian-Ukrainian war, dry bulk companies have been hit hard. After reaching records in the summer of 2021, the The Baltic Dry index has been steadily falling for the past few months, with the exception of the last few weeks. The greatest volatility was seen in the larger ship segments, and in particular in the Capesizes. It’s been a roller coaster ride and certainly not for the faint hearted.

In this context, there is Safe Bulkers, Inc. (NYSE: SB), a company that owns a total of 44 vessels, from Kamsarmaxes to Capesizes, while also waiting for the delivery of 9 new builds (7 Kamsarmaxes and 2 Post – Panamax).

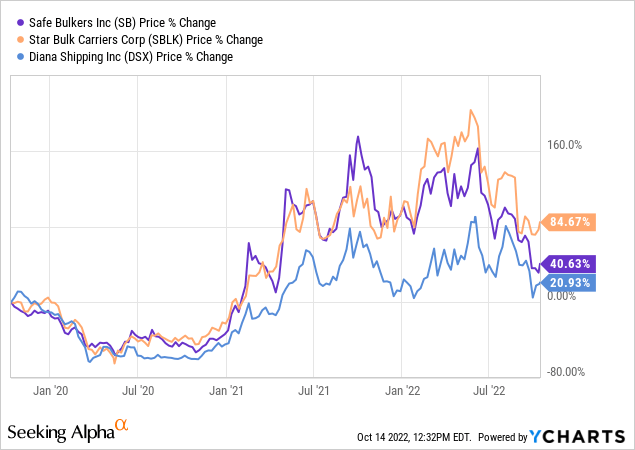

As we can see in the graph shown here, over the past three years the price of Safe Bulkers has increased by 40%, being in the middle of our peer group. I normally use total return in this chart, but since Safe Bulkers recently launched a dividend for its common stock, I think the price appreciation is better.

Valuation of SB shares

I will use the same peer group in order to get an idea of the relative valuation of the company. However, please note that the vast market capitalization gap between Star Bulk Carriers (SBLK) and the rest of the companies is a limit to this comparison. As of this writing, shares of Safe Bulkers are trading at 1.9 times its forward earnings, while its peers are trading at nearly double valuations. Specifically, Star Bulk Carriers and Diana Shipping (DSX) are currently trading at 3.3 and 3.6 times forward earnings, respectively. The same is true from an operating cash flow perspective, as Safe Bulkers trades at just 1.25 times their operating cash flow and its peers at nearly twice that figure.

When it comes to revenue growth, the company sits in the middle of the peer group. Over the past five years, Safe Bulkers has seen revenue grow at a CAGR of 23%, while Star Bulk Carriers and Diana Shipping’s respective figures are 45% and 17%.

So, we can see that in every metric, the market is quite conservative compared to Safe Bulkers, compared to its peers. And although from a personal point of view, I think Star Bulk Carriers is the best company in its class, I really think that such a discount to Safe Bulkers is not justified by its financial performance so far.

Reasons to doubt the current low valuation

There are several reasons why someone might think the market has been too tough on this one:

- Fleet modernization: As I wrote in the introduction to this article, Safe Bulkers is expecting the delivery of 9 new ships. In case you didn’t know, modern ships provide an added benefit to businesses in several ways. First, they are more cost effective and most likely equipped with a scrubber. This means they can run on cheaper “heavy” oil, which increases operating margins. This becomes especially important as the VLSFO/HSFO oil price differential widens. Currently, high/low sulfur oil differentials range from $225 to $321 per tonne. These figures, although far from the $500+ observed last summer, still have a strong impact on companies’ operating margins. Of the 44 ships owned by Safe Bulkers, 18 of them have scrubbers installed, while another 5 are in the process of installing scrubbers. Second, shipowners need to invest in better performing vessels in order to comply with stricter environmental policies that will become mandatory in the future. From 2023, the taxes paid will be directly and positively correlated to CO2 emissions. Currently, the tax rate per tonne of CO2 is EUR 100. In this context, the new constructions of the company M/V Vassos and M/V Climate Respect operate in class A energy efficiency and below the environmental minima of phase III. According to company CEO Polys Hajioannou, modernizing the fleet is the company’s number one priority. However, don’t expect any shocking fuel modification decisions until 2024, as there is currently no clear direction on this.

- Attractive dividend in supporting role: As I wrote earlier, the company launched its common stock dividend a few months ago, and it currently pays $0.05 per share, which represents a dividend yield of 7.4%. Apart from this, the company also has its preferred stock series C and D, with a dividend yield of 8.4%. While these numbers aren’t that impressive compared to other shipping stocks, they certainly add spice to the whole investing story. But still, I believe the primary role here belongs to the capital appreciation perspective.

- Alignment of interests: One thing I look for when looking at companies is if their management has a role to play. This is especially true for Safe Bulkers, with insiders owning 25% of the total shares and 40% of the company, while in Star Bulk Carriers, for example, there is a single digit figure. In addition, nearly 28% of the company’s shares are in the hands of institutional investors.

At the end of the line

There is no doubt that tough times are ahead for shippers, and especially those with exposure to larger ship segments, such as Safe Bulkers. However, as a long-term investment, the business is significantly undervalued. In addition, increased capital expenditure on fleet modernization will eventually materialize as environmental regulations become more stringent and the price differential of high/low sulfur oil is significant for costs. of business operation. On top of that, the single-digit dividend yield could remove some of the uncertainty and provide a nice cushion against price swings. It will be a bumpy ride, but with ownership interests so well aligned with public investors, I think the returns will be significant going forward.